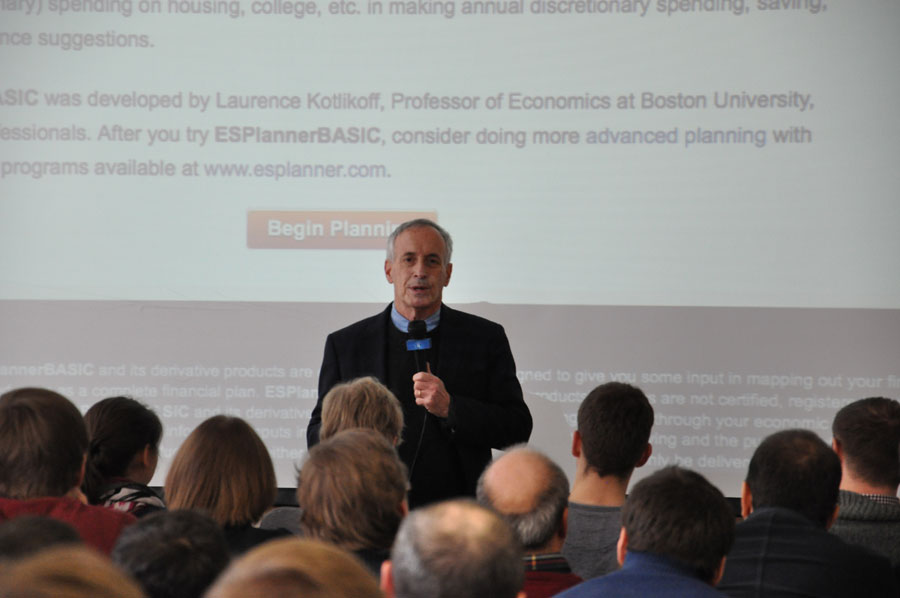

Honorary Lecture by Professor Lawrence Kotlikoff at HSE ICEF

On January 15, Professor Larry Kotlikoff gave a talk on measuring inequality in lifetime spending power within different age cohorts in the USA, net tax rates facing Americans, and current wealth indicators.

Lawrence Kotlikoff is a highly distinguished economist with over 200 published papers and numerous books on economics of intergenerational relations, consumption, saving, taxation, public finance and personal finance, in which areas he is a global specialist and consultant. He has served as Chief Economic Advisor to the US President, many national (including Russian) and international organizations, and has been a candidate for US president himself (2012).

Professor Kotlikoff is well-known for his work questioning the importance of saving for retirement in determining total U.S wealth accumulation (with Lawrence Summers). Together with Alan Auerbach, Prof Kotlikoff developed the first large-scale computable general equilibrium life-cycle model of economies comprising of a large number of overlapping generations. He is also known as a very substantive critique of the existing approaches to measurement of inequality using existing macroeconomic indicators many of which, he claims, are ill-defined. He eloquently elaborated on that view during his HSE lecture, which has been attended by more than 150 faculty and students. In particular, he advocated the use of spending rather than current income as the real measure of people's lifetime wealth, as the former tends to be a more reliable and time-invariant indicator of lifetime earning abilities. Proper measurements of income and inequality are important to qualify the issues of capital accumulation dynamics advanced recently by Thomas Piketty, as well as to fiscal imbalances, progressivity and regressivity of the tax scales, intergenerational transfers, ecological sustainability and other aspects of global economic development.

The audience will definitely remember his presentation of lifetime budgetary plan illustrated using special Fiscal Analyzer software developed by his company, as well as a live illustration of the virtual character of current wealth indicators (proven by the destruction of a $10-bill in real time by one of the attending students).

See also:

HSE University and University of Campinas Join Forces to Build Alternative Financial System

HSE University and the University of Campinas (UNICAMP, Brazil) have announced the launch of a major joint research project to develop new approaches to an alternative international financial system. The initiative, which brings together leading experts in global economics and finance, seeks to analyse the current state of international financial architecture and explore ways of transforming it in the context of a changing geopolitical landscape.

‘Teaching Is a Learning Experience for Me—Every Question Is an Opportunity to Update My Lecture Material’

Kemal Kivanc Akoz is an Assistant Professor of the Department of Theoretical Economics at the Faculty of Economic Sciences. He has been at HSE University for six years and his current activities include research into marriage market dynamics and information agreements among groups of agents. In this interview with the HSE News Service, Kemal talks about the subjects of his research, the teaching approach that led to him being named one of the university’s Best Teachers, his favourite places to get a coffee in Moscow, and more.

LFE-ICEF International Finance Conference: Exchanging Ideas and Building Networks

On November 22, 2024, the International Laboratory of Financial Economics (LFE, ICEF HSE) hosted the 13th International Moscow Finance Conference, bringing together researchers and experts from various countries to discuss current issues in financial economics. In his welcoming speech, Vladimir Sokolov, Head of the Laboratory, emphasised the significance of financial market research for the global economy.

‘I Hope You Have Entered the Economic Profession Consciously’

On November 11, 2024, the HSE Faculty of Economic Sciences hosted a celebration for Economist Day. Many of the university's partners came to congratulate HSE on the occasion. The atrium on Pokrovsky Bulvar hosted booths from VkusVill, Ozon, HeadHunter, Wildberries, and other leading companies. Students and professors participated in quizzes, spun the wheel of fortune, painted, and crafted.

Maxim Reshetnikov: ‘An Effective Open Market Economy Has Been Built in Russia’

On November 11, 2024, during Economist Day in Russia, Maxim Reshetnikov, Russian Minister of Economic Development, spoke to students of the HSE Faculty of World Economy and International Affairs about Russia’s foreign economic activities, how the country managed to withstand unprecedented sanctions pressure, and the current state of its development.

‘Studying Is in Many Ways Like Sports’

Georgy Khvatkin, first-year student of ICEF International Bachelor’s Programme in Economics and Finance, won gold at the World Cadet, Youth and Junior Sambo Championship. Georgy proved his superiority in the 98 kg weight category. He shares, how he decided to enroll in ICEF, when he started practicing Sambo, how regularly he trains, what role Jackie Chan played in his becoming a pro athlete, and the support his family provides to him.

FES Announces the Winner of the Nobel Prize in Economics 2024 Prediction Contest

The HSE Faculty of Economic Sciences summarised the results of its traditional prediction contest. FES holds this contest annually on the eve of Nobel Week. This year, the contest once again attracted participants from different regions of Russia and countries around the world. Remarkably, one participant managed to predict all three laureates of the 2024 Economics Prize.

Try Your Hand at Predicting the 2024 Nobel Prize Winner in Economics

The Faculty of Economic Sciences is launching its annual prediction contest. On October 14, the Nobel Committee will announce the winners of the Sveriges Riksbank Alfred Nobel Prize in Economic Sciences live on air. You have time to prepare and explore the landscape of contemporary economic thought. What topics and areas are considered particularly important and promising at the moment? Anyone can win.

ICEF Awarded Diplomas to Graduates of Bachelor's and Master's Programmes 2024

More than 200 graduates gathered in the hall of the HSE Cultural Centre, where their parents, the leadership of HSE University and ICEF, teachers, and numerous guests came to congratulate them.

Choosing the Right Server Results in Better Outcomes in Doubles Tennis

The Roland Garros tennis tournament, one of the most prestigious in the world, began on May 26. The prize money for this year's French Open totals nearly 54 million euros, with athletes competing in both singles and doubles events. In doubles tennis, choosing the right strategy for a match is crucial. Athletes' ability to adapt to the dynamics of the match and strategically choose the server can earn the pair up to 5% more points, according to Nikolai Avkhimovich, doctoral student and research fellow at the Laboratory of Sports Studies of the HSE Faculty of Economic Sciences. A paper with the study findings has been published in Applied Economics.